|

You want to be close to work, your friends, coffee shops and your favorite dog park, right? Well, have you thought of these other things to help you decide where you should buy a home?

Checklist: What to Investigate Around & Outside a House You should be most concerned about things that cannot be changed or at least not easily changed. Consider the following questions: • Are there proposed changes in the neighborhood such as a new school, apartment building or shopping complex? • Do you look out at ugly powerlines from the home? Even if you don’t mind them, when you go to sell the home it will become a problem with buyers. • Is there a bus or transit train stop outside the house that will attract loiterers? My brothers neighbor has a bus stop in front of his home and people waiting there regularly break boards out of his picket fence! • Do you see into junky neighbor yards when you’re inside the home? • What's next door or down the street that could cause unwanted foot traffic. 7 Eleven? Commercial building? School? Park? My grandmothers home was down the street from a high school and the kids would come smoke in her backyard because it was not allowed on campus! • If you’re in the backyard, does it feel like you're in a "fishbowl" with 2 story neighboring houses looking down at you? • Are there double yellow lines or speed bumps in the street? That usually means a busy road or occasional speeding traffic. • How close are neighboring homes? Are you comfortable with the distance from others? • Is the driveway too steep to navigate easily every day? A driveway sloping toward the home can cause a surprising amount of rainwater to flow into your garage or yard • Is the garage attached to the home and is that important to you? • How much noise can you hear inside from highways, neighbors, airplanes, or trains? • Are you at the end of a street that will cause car headlights to shine into your living room every night? • Would you want to and be able to walk or bike to stores, restaurants, parks, etc? • Will you have to fight for street parking? What have your friends found they liked/disliked about their neighborhood? We hope this has been eye-opening and helpful!

1 Comment

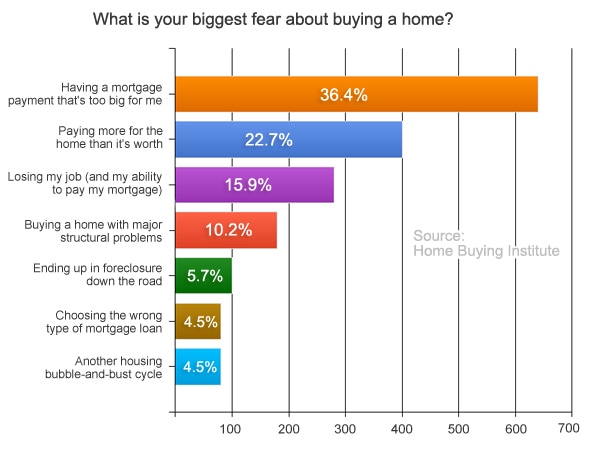

Its perfectly normal to feel fear when thinking of buying a home- everyone who buys a home has fears so you're not alone! The key is to address the fear with Planning and Education and then move forward. As we say, you can't steer a parked car! Check out our classes at www.portlandhomebuying101.com to help you take fear off the table and move forward with confidence.

Having cash for a down payment is the biggest obstacle most first time buyers face so you are not alone! Here are some ideas for funds:

Or... ask your lender about zero down loan options. Always talk to your trusted loan officer before making any of these decisions however as rules do apply! Yes and No is our clear and unambiguous answer!

Every year about this time as summer is wrapping up, buyers and sellers get distracted with squeezing in last minute vacations while the weather is good, going to weddings & reunions and getting ready for back to school. This makes things slow down and we are seeing that happening now. So, yes, things have cooled off the last several weeks but the overall market is still very strong and prices appear to be going up, just not at such an alarming rate. This is a good thing as we cannot keep having 15% plus appreciation every year! What Are Your Top 5 Home Buying Worries?

1. How do I boost my credit rating? The only source that is is recommended by the Federal Trade Commission (FTC) is annualcreditreport.com. The FTC has the most trustworthy site we've seen for repairing or boosting your credit scores. Contact your lender to help you with a credit consultation based on your credit report- you can never have too good of credit for a mortgage! 2. How much home can I afford? You can go online and use mortgage calculators, but we really don't recommend it. The reason is that there are far too many variables to make them accurate and a wrong answer can often be worse than no answer at all! Talk with an experienced, trustworthy loan officer for 30 minutes and you'll know for sure how much you can afford. 3. What neighborhoods are best for me? It really depends on many factors- mostly what you can afford and distance to work and your friends. You'll want to sit down and have a chat with us for 20-30 minutes and we'll help you choose a few good areas that are best for you. 4. Is now really the best time to buy? If your job and finances are stable, it really is a good time to buy. The conditions are the best we've seen in decades due to historically low interest rates and rising home prices. 5. Which agent should I use? The best one you can find. We think this is where many buyers go wrong, thinking "Aren't all realtors pretty much the same?" It is easy to see how you could come to that conclusion, so ... How are we different from most agents? 1. Our focus is on our clients needs not our own... we concentrate on your concerns, not on promoting ourselves with things like glamour shots of us on bus benches or billboards! 2. We work hard to educate you each step of the way so that you know what is happening and know that you're making good decisions. Our home buying classes are just the first step we take in educating our clients through the whole home buying process. What should you do next? Give us a call or email and we'll sit down with you to talk about these 5 concerns and see if we'd be a good fit to work together on buying your first home. Thanks! Dave Axness Our terrific home inspectors shared these common defects found in most homes:

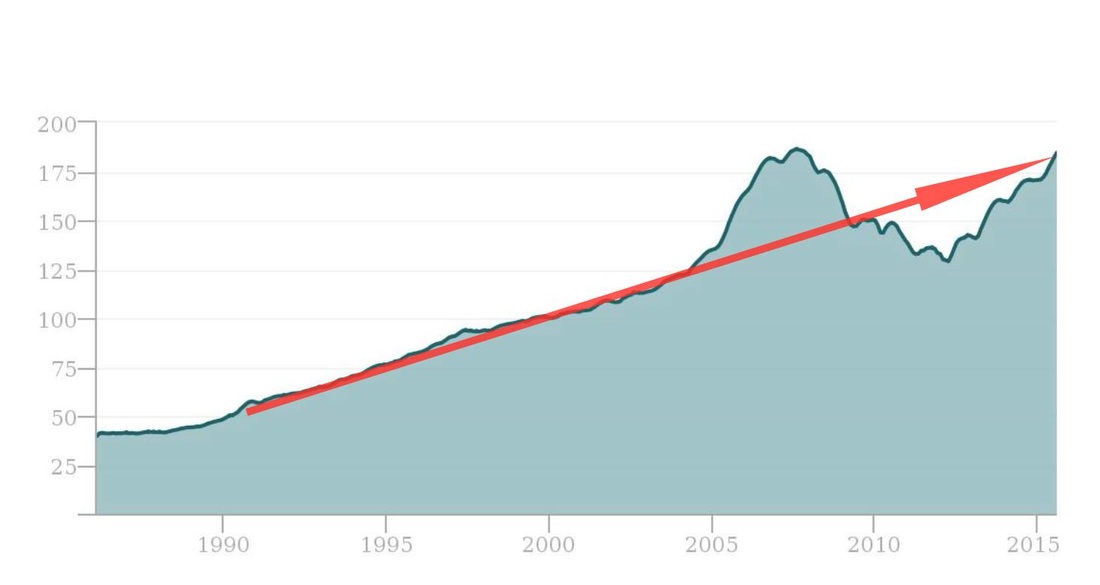

Sorry, that might have been a misleading headline! We meant to say Have Portland Home Prices Gotten Too High? Below is a graph of Portland home prices over the past 25 years. From 1990 to 2005, home prices rose at a steady rate. In 2005, lending rules were too lax and loans were given to too many home buyers. You can see how 2007 was the peak of the market and then the dramatic drop. But the fascinating thing is that if we didn't have the boom and the crash, home values would be right where they are today. What is the bottom line? The real estate market is healthy and where it should be. Its not easy to find homes, but we are doing it every day for our buyers with some creativity.

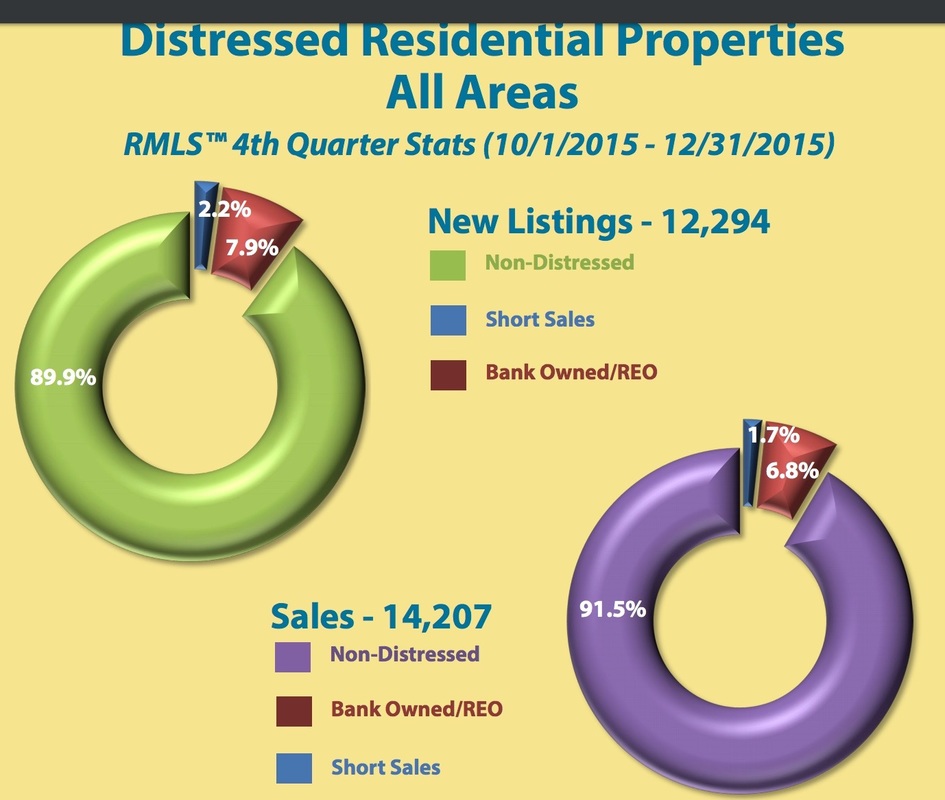

Are we finally done with Short Sales?? Only 1.7% of home sales are short sales and 6.8% Bank Owned. This means a very healthy real estate market.

|

AuthorWe've been teaching home buying classes in Portland for 14 years and are passionate about helping you Learn before you Buy! Archives

August 2017

|

RSS Feed

RSS Feed